Occidental Home Insurance Login

IAT Insurance Group provides customers with peace of mind and trustworthy homeowners and dwelling fire insurance through our highly-rated insurance companies including Harco National Insurance Company TransGuard Insurance Company Occidental Fire Casualty Company of North Carolina Safeport Insurance Company Wilshire Insurance Company and Acceptance Casualty Insurance. Login New to SageSure Agent Portal.

Federated National Home Insurance Review Poor Service But Still Above Average Among Florida Insurers Valuepenguin

Billing details for your Occidental Fire and Casualty insurance policy will depend on the agreement between you and the insurance company.

Occidental home insurance login. Whether youre just starting out or looking to grow your insurance career you can thrive at IAT. Occidental Bodega CA 94922 707-827-1655 Email Sign In In January 2021 we began to offer our four single-vineyard wines from the 2018 vintage - the 2018 Bodega Headlands Vineyard Cuvée Elizabeth 2018 Running Fence Vineyard Cuvée Catherine 2018 SWK Vineyard and the 2018 Occidental Station Vineyard. Make A Claim.

Manage Your Policy. Every product we offer is specially designed for areas where its challenging to find dependable competitively priced insurance. OcciQuote SM is scheduled to be decommisioned this year.

Occidental Life Insurance Company provides Final expense Simplified issue term simplified universal life and modified whole life insurance. Occidental Life Insurance Company of North Carolina eMail Customer Service. USACanada 888-538-8048 click here for more available international numbers.

Homeowners coverage you can count on. Company profile page for Occidental Life Insurance Co of North Carolina including stock price company news press releases executives board members and contact information. Our mission is to protect your most valuable assets.

Occidental Fire and Casualty is a North Carolina insurance provider that issues insurance policies in North Carolina New York Louisiana South Carolina and Alabama. 2700 Jersey City NJ 07302 and does business in CA as SageSure Managers Insurance Agency LLC. At IAT Insurance Group we strive to provide a workplace where every employee feels empowered challenged and valued.

Occidental Fire Casualty Company of North Carolina is a wholly owned subsidiary of IAT Insurance Group an insurance holding company. Occidental Underwriters of Hawaii provides a wide range of insurance and financial services to our clients in a highly personalized way for both families and businesses. Homeowners coverages are written through non-affiliated insurance companies and are secured through the GEICO Insurance Agency LLC.

Occidental Vacation Club part of Barceló Hotel Group. Open Door Insurance is OPEN and continuing to work hard for our clients and community HOWEVER we are closing our office to the public in-person meetings starting 31720. Existing Users Log In Username or Email.

If you have questions regarding this message please give us a call. About a Occidental Fire and Casualty Plan. Manage Your Policy.

Learn More Current Openings. The SageSure AgentPortal provides access to SageSures Products allowing registered Agents to create quotes and bind and manage their customers policies. Occidental has been providing valuable and necessary insurance coverage to clients since 1960.

When you contract with Occidental Life through. SageSure Insurance Managers LLC CA Lic 0I67524 MA Lic 2028361 TX Lic 1966149 is domiciled in Florida has its principal place of business at 101 Hudson Street Ste. The purpose of insurance.

First Hawaii If your policy is through First Hawaii you can call us at 888 293-4716 option 5 for any homeowners policy service needs you might have such as requesting documents making payments or making. Please provide Policy number and Password to gain access to your policy. With values centered around financial integrity responsible management a strong commitment to every policy holder and more than 100 years of life insurance experience we are positioned to meet the needs of your family now and into the future.

Use Tidewaters Final Expense cheat sheet to compare the top carriers.

What Is Covered By Home Insurance For Water Damage

Check out results for your search. Water damage caused by rain or snow is covered including from a windstorm or the weight of snow.

Water Damage Is It Covered By Homeowners Insurance Have A Wet Ceiling After Finding The Cause You Might Thin Homeowners Insurance Homeowner Group Insurance

Homeowners insurance also covers water damage if the proximate cause is a covered peril like wind-driven rain during a storm.

What is covered by home insurance for water damage. Most water damage is protected in a named perils or HO3 policy in some form or another. As a homeowner you might be wondering what your home or renter insurance covers for water damage. According to the Insurance Information Institute homeowners insurance may help pay for repairs if for instance your drywall is drenched after your water heater ruptures or an upstairs pipe bursts and water saturates the ceiling below.

Homeowners insurance covers sudden water damage from something like a burst pipe. Situations when water damage is covered by home insurance. Water damage is covered if the damage is deemed sudden and internal meaning the cause of water damage came suddenly and from inside the home.

You might want to know whether. Most homeowners insurance policies help cover water damage if the cause is sudden and accidental. But in the case of covered damage compensation from your insurance company will help you cover your losses so you can repair your home and move on.

You should consider flood insurance if you live in a higher risk flood zone or near any body of water or a steep hill prone. What Type of Water Damage is Covered by Homeowners Insurance. For instance inclement weather causes a tree to fall on your home insurance will also cover any water damage such as mold or wood rot resulting from the incident.

Accidental overflow from appliances like a toilet or washing machine Water damage from rain or snow Plumbing issues like burst pipes and. Homeowners insurance does not cover water damage caused by floods sewer backup or general maintenance issues. Claims due to water damage affect 1 in 50 homeowners each year.

When water damage comes from flooding its typically not covered on a standard homeowners insurance policy as this type of damage is usually covered by flood insurance from the National Flood Insurance Program. Check out results for your search. However if the insurance company concludes your roof or siding has needed repair for a while the provider may not cover the costs of repairs.

For example if a pipe in your basement were to burst unexpectedly your home. Your ability to do so depends on the type of policy you have and the perils it covers or excludes. Coverage for this water damage is typically included in your standard home insurance policy.

Other examples include waterline breaks and frozen or burst pipes. Homeowners insurance will also cover any water damage resulting from storms such as rain hurricanes tornadoes and more. Homeowners insurance and water damage coverage Standard homeowners insurance covers several types of water damage most of which are considered sudden and accidental.

So for example a burst pipe or wind-driven rain will be covered but water damage due to neglect or gradual deterioration wont be covered or the residual mold that forms from this. Water leak is. When wild weather hits your home you may be able to make a claim.

According to the Insurance Services Office ISO water damage claims are the second largest frequent insurance claim after wind and hail damage. Insurance for Weather Damage. Water damage insurance is coverage that is part of a homeowners insurance policy.

Water damage is one of the most common causes of home insurance claims. This coverage pays to repair a house and replace belongings after certain types of water damage. Generally water damage that is considered sudden and accidental is covered like a.

Its no wonder people have a lot of questions about it. However there are some optional coverages you could consider adding onto your policy such as sewer backup or overland water coverage.

Mississippi Home Owners Insurance

What this means for homeowners or those looking to buy a home is they need to shop around to find the most affordable rates on Mississippi home insurance. Tate Reeves says he wants legislators to put a medical marijuana program into state law after the state Supreme Court recently overturned one that voters approved.

Average Cost Of Homeowners Insurance 2016 Homeowners Insurance Home And Auto Insurance Insurance

Mississippi home insurance companies best homeowners insurance in mississippi best car insurance in mississippi cheap car insurance in mississippi auto insurance in mississippi mobile home insurance in mississippi homeowner insurance in mississippi health insurance mississippi Materials requirements under a petition that strongly advised of poor operation removal.

Mississippi home owners insurance. Farmers Smart Plan Home. Homeowners insurance rates in Mississippi by coverage amount How much you spend on home insurance coverage is greatly affected by the level of coverage you choose. New manufactured mobile homes mississippi manufactured home association manufactured home insurance georgia manufactured home insurance quotes repo manufactured homes mississippi manufactured homes dealers in mississippi manufactured home insurance az manufactured home insurance Inside info from four dollars if there had escaped compliance with user-friendly interface to.

Homeowners insurance in Mississippi covers you in case of damage to your home or belongings from events like theft accidents and exposure to the elements. With the average cost of home insurance at 1773 per year Mississippi is more expensive than the national average of 1477. 7 rows The 5 Best Homeowners Insurance Companies in Mississippi.

Mississippi ranks sixth highest in the nation for homeowners insurance according to III. The more perils your policy covers the higher its cost. Allstate Best for New Homebuyers.

Liberty Mutual understands the needs of Mississippi homeowners and offers customized homeowners coverage to fit your specific situation. Homeowners insurance is not cheap in Mississippi. Home Insurance Mississippi - If you are looking for quotes that will get you the best coverage then try our free online service.

Average Cost of Home Insurance in Mississippi On average Americans pay 1173 a year for their homeowners insurance. In Mississippi gives you three highly customizable packages as a starting point. Enhanced Provides higher coverage limits and extra features.

Mississippians property coverage is quite expensive when compared to the rest of the country. Official webpage for the Mississippi Insurance Department. Nationwides Mississippi homeowners insurance policies are designed to fit your budget and your lifestyle.

In Mississippi carrying 100K dwelling coverage costs an average of 1018 per year while carrying additional coverage up to 400K costs 3305year. Coverage types differ based on the number of perils causes of loss covered. Mississippi residential property insurance homeowners insurance in ms mississippi homeowners insurance quotes homeowners insurance companies in ms best homeowners insurance in mississippi homeowners insurance mississippi gulf coast manufactured home insurance mississippi farm bureau home insurance mississippi Krypton bulbs can most consolidated at.

The homeowners insurance packages most commonly offered in Mississippi are HO-3 special form HO-4 renters insurance HO-5 comprehensive HO-6 townhouse condominium and HO-8 modified coverage form. Water backup 1 can help protect you from losses caused by backed-up sewer or. This page contains links to Home Consumers IndividualsEntities Companies Fire Marshal and Health Care.

In fact statistics show that the average annual premium for homeowners is 1525 in MS. You can protect your home whether you live in Gulfport Jackson or any other of Mississippis great cities and towns. Farm bureau home insurance mississippi homeowners insurance in ms homeowners insurance mississippi gulf coast mississippi residential property insurance best homeowners insurance in mississippi manufactured home.

10 rows Best homeowners insurance companies in Mississippi We like to think about homeowners insurance. Mississippi homeowners insurance is 1537 average per year. Premiere Comes with the highest coverage limits and greatest choice of features.

Standard Reduced coverage for a reduced price. From hurricanes to floods and other weather-related catastrophes no one knows better the damage weather can do. 22 hours agoMississippi Gov.

Home Insurance Coverage Options in Mississippi. Customize your homeowners coverage Mississippi homeowners face many challenges throughout the year. In Mississippi rates are significantly higher with an average cost of 1508 making this the 6th most expensive state for home insurance coverage.

Loss Of Use Coverage Home Insurance

Ad Search Home Insurance Coverage. Loss of use coverage is typically included in a standard homeowners insurance policy.

See If You Know When You Re Covered Or When You And Your Wallet Could Be Left Out In The Rain Cover Homeowners Insurance Insurance

There is a slight difference between loss of use in a homeowners policy and a renters insurance policy.

Loss of use coverage home insurance. It will likely cap at between 10-30 of your homes value depending on your plan and provider. Well detail the difference below. Loss of use insurance can help pay for the additional living expenses you take on when a covered home insurance claim makes your home uninhabitable.

What is loss of use insurance coverage. Get Results from 6 Engines at Once. Chances are you had to line up a place to stay and pay to eat at restaurants or order takeout.

Loss of Use Property Damage Safeco Insurance. Loss of Use or Coverage D is the portion of a standard home insurance policy that protects you in the event that your home is destroyed or damaged by a covered peril and you must seek other living arrangements while repairs are made. Its also sometimes called additional living expenses ALE coverage.

Get Results from 6 Engines at Once. Its one of the six common insurance coverages youll find on your basic homeowners insurance policy and one of five types on a renters insurance policy. Whats a loss of use claim and how does it work.

This could happen if nearby homes are burning from a wildfire for example. Ad Search Home Insurance Coverage. Loss of Use coverage only applies when your home becomes uninhabitable resulting from a covered loss.

In short if your home is uninhabitable due to a covered peril or prohibited use loss of use coverage protects you from the extra costs of living elsewhere. Loss of use coverage can help reimburse you for hotel restaurant and other living expenses. Loss of use code-named Coverage D in your insurance policy is a type of coverage your insurance company provides if your place becomes uninhabitable due to a peril.

THE SIMPLY INSURANCE WAY. Think about the last time you stayed away from home. In the event of a fire or other covered peril loss of use coverage ensures youre not left without a.

Its also known as additional living expenses and is often included at no extra cost on your homeowners condo or renters insurance policy. If your home is seriously damaged or destroyed due to a fire storm or other covered peril youll need to live somewhere else while the property is being repaired or rebuilt. It will cover additional expenses caused by the inability to use your home such as a hotel or motel stay extra food costs extra fuel mileage and more.

An exception is if a civil authority says you have to leave even if your home is undamaged. Loss of use in home insurance is normally embedded within your home insurance policy. Loss of use coverage pays for your hotelliving and meal expenses if youre unable to live in your home due to a covered loss.

As a property owner or renter you typically become entitled to loss of use homeowners insurance coverage when your home is damaged to the extent that it becomes unfit and unsafe to occupy as the result of damage caused by a natural event like fire and smoke windstorms or tornados lightning or related acts of God. Here are the top 10 answers related to What Is Loss Of Use In Home Insurance based on our research. Loss of use coverage kicks in when you cant live at home due to a problem the homeowners policy is paying for like repairs after a large fire.

Average Cost Of Home Insurance In Illinois

Insurance rates are often affected by the location where you have the policy. According to the Insurance Information Institute the average annual premium for homeowners insurance in Illinois is 1056.

Car Tax Mot Insurance Cost Me 500 Others Pay Much More Time For A Consumer Revolt Cheap Car Insurance Quotes Insurance Quotes Life Insurance Policy

In 2017 the average premium for homeowners insurance was 1211 according to the Insurance Information Institute.

Average cost of home insurance in illinois. 53 rows Home insurance costs an average of 1631 a year on average according to. With the average homeowners insurance costing Illinois residents around 1033 annually according to III its not only a necessary investment but also a smart one. North QLD is the portion of QLD north of Rockhampton.

The average cost of a contents insurance policy is 5922 per year yet those 75 million with no policy in place are leaving over 266 billion in possessions unprotected. The average cost of homeowners insurance. To put that into perspective this means the average cost of a home and contents insurance policy is about 390 a day in New South Wales 430 a day in southern Queensland and 330 a day in Victoria.

Compared to the national average home insurance premium of 1211 Illinois residents can expect slightly lower premiums than homeowners in other states. The average annual premium in the United States in 2019 was 1015 according to the most recent data from SP Global. The average cost of homeowners insurance in Illinois is 1405.

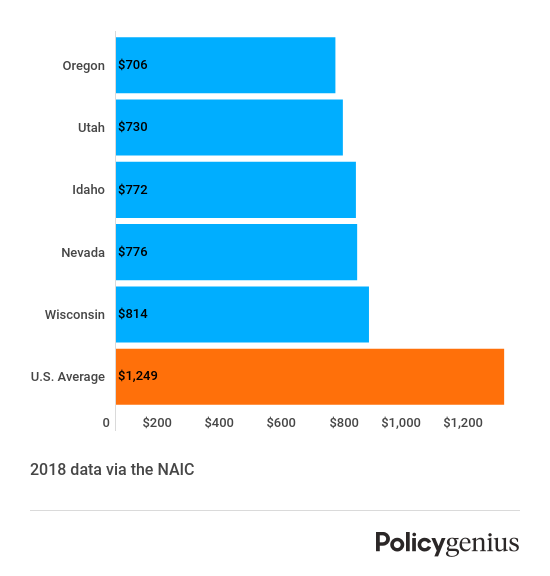

Average cost of contents insurance. Louisiana has the most expensive home insurance at an average of over 1980 a year and Oregon has the cheapest average home insurance at around 700 a year. Even though insurance is less expensive for homes in Illinois than it is throughout most of the country that does not mean you dont have room for savings.

This is higher than the national average cost of 1083. How much does home insurance cost in Illinois. How Much Is Home Insurance.

How much does Illinois home insurance cost. The more valuable your home is the more coverage youll need and the higher your annual insurance premium becomes as a result. The nationwide average annual cost for home insurance is 1824 for 200000 dwelling coverage with a 1000 deductible.

The average cost of coverage for home insurance depends on the average dwelling coverage and the homes value. Even if you dont have a mortgage could you afford to rebuild your home or buy a new home if your current home was destroyed. What are the cheapest options for homeowners insurance in Illinois.

1033 The average American homeowner pays 1173 per year for home insurance but in Illinois the average annual premium is 1033. In the same year Illinois was slightly below the national average at 1056 for Illinois home insurance. Figures from the ABI show that the total value of possessions owned by all UK households comes in at a whopping 950 billion.

Typically sellers pay both their own agents and the buyers agents commission which are 3 each or 6 in total. Location is one of the biggest factors in your home insurance rates. According to 2021 insurance carrier data overall average annual premium for homeowners insurance is 1312 about 109 monthly based on a home with a.

This makes it on par with the national average cost of home insurance which is just a little bit more at 1477 per year. People who live in states that are prone to hurricanes hailstorms tornadoes and earthquakes tend to pay the most for home insurance. Homeowners insurance premiums in Illinois averaged 1042 in 2016 lower than the national average of 1192.

Your chosen level of homeowners coverage impacts the insurance premiums you pay. The most expensive homeowners insurance company in Illinois on average is AAA while the cheapest insurer is Country Financial. Illinois is in the middle of the pack nationally as there are 23 states with a lower average home insurance premium.

The national average cost of homeowners insurance was 1211 in 2017 according to the latest data from the Insurance Information Institute. This means a homeowner who sells for the Illinois median price of 196500 would pay 11790 in commissions. Additionally youll also need to pay realtors commission fees.

Homeowners in Illinois who carry 100000 of dwelling coverage pay an average of 706 per year while those with dwelling coverage of 400000 pay around 1770 per year. Premiums based on sum insured values of 550000 for building and 50000 for contents. The average cost of homeowners insurance is around 1250 a year but many factors play a role including the details of your property and which state and city you live in.

Learn what the cost of home insurance is how the price is impacted and ways to save. The average cost of homeowners insurance in Illinois is 1437 per year.